|

Listen to this article

|

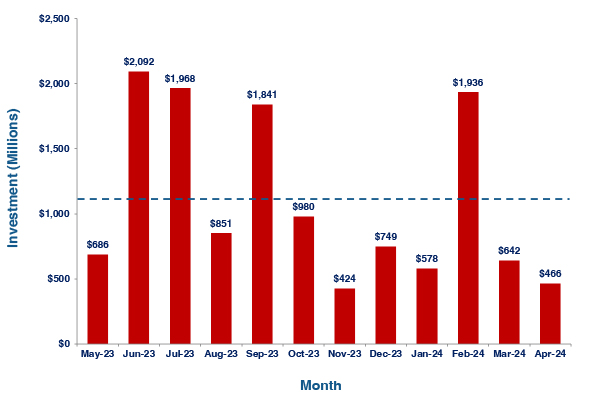

Figure 1: Global Robotics Investment – Trailing 12 Months.

Robotics investments reached at least $466 million in April 2024, the result of 36 funding rounds. The April investments figure lagged recent months and was the smallest amount since November 2023. April 2024’s investment total was significantly less than the trailing 12-month average of $1.1 billion (see Figure 1).

Providers of collaborative robots scored the two largest rounds. As described in Table 1, Collaborative Robotics’ $100 million Series B round was April’s largest investment. As its name implies, the California-based firm is developing collaborative robots and enabling software for their use. China’s Rokae, a provider of collaborative and industrial robots, secured $70 million in April.

April 2024 Robotics Investments

| Company | Amount ($) | Round | Country | Technology |

|---|---|---|---|---|

| 10Lines | $1,605,004 | Series A | Estonia | Outdoor Mobile Robots |

| Accelerating Evolution | Estimate | Series A | China | Exoskeletons |

| Adagy Robotics | $500,000 | Pre-Seed | USA | Software |

| Adamo Robot | Estimate | Other | Spain | Rehabilitative Robots |

| Allen Control Systems | $12,000,000 | Seed | USA | Defense Technology |

| Asensus Surgical | $20,000,000 | Other | USA | Surgical Robots |

| AutoPylot | $1,525,400 | Other | USA | Software |

| BurnBot | $20,000,000 | Other | USA | Service Robots |

| Collaborative Robotics | $100,000,000 | Series B | USA | Collaborative Robots |

| Control One AI | $350,000 | Pre-Seed | India | Software |

| CYNGN | $5,000,000 | Other | USA | Mobile Robots |

| Deltia.ai | $4,800,000 | seed | Germany | Picking Robots |

| Excelland AI (Uditech) | Estimate | Other | China | Mobile Robots |

| Forcen | $6,100,000 | Other | Canada | Force/Torque Sensing |

| Formic Technologies | Estimate | Other | USA | Collaborative Robots |

| Fotokite | $10,990,738 | Series B | Switzerland | Drones |

| Fox Robotics | Estimate | Other | USA | Autonomous Forklifts |

| Greeneye Technologies | $20,000,000 | Israel | Precision Agriculture | |

| HyLight | $3,900,000 | Other | France | Precision Agriculture |

| ikitbot | Estimate | Seed | China | Mobile Robots |

| Innoplier (Harbin Gong Zhiling) | $1,250,000 | Seed | China | Mobile Robots |

| K-Scale Labs | $500,000 | Pre-Seed | USA | Humanoids |

| Kalman | $365,330 | Seed | Korea | Quadrupeds, Unmanned Underwater Vehicles |

| Kraken Robotics | $57,768,023 | Other | Canada | Sensing |

| Mengyou Intelligence | $3,000,000 | Seed | China | Robotic Toys |

| Mentee Robotics | $17,000,000 | Other | Israel | Humanoids |

| Moying Robotics | $13,824,757 | Series A | China | Mobile Manipulators |

| Olivaw Robotics | $1,303,458 | Pre-Seed | Germany | Software |

| Pipedream Labs | $13,000,000 | Other | USA | Mobile Robots |

| Pivot Robots | $500,000 | Pre-Seed | USA | Software |

| Planys Technologies | $5,157,511 | Seed | India | Unmanned Underwater Vehicles |

| Raion Robotics | Estimate | Seed | Korea | Quadrupeds |

| Rise Robotics | $14,364,512 | Other | USA | Motion Control |

| RisenLighten | Estimate | Seed | China | Software |

| RoboBurger | $1,500,000 | Other | USA | Other Commercial |

| RoboMinder | Estimate | Seed | UK | Software |

| Rokae | $70,506,944 | Other | China | Collaborative Robots |

| Serve Robotics | $40,000,000 | Other | USA | Mobile Robots |

| Shinkei | $6,000,0000 | Seed | USA | Precision Agriculture |

| SpinEM Robotics | $10,703,452 | Series A | France | Surgical Robots |

| TerraClear | $15,306,337 | Series A | USA | Precision Agriculture |

| Venus Concept | $5,000,000 | Refinancing | Canada | Surgical Robots |

| Vitestro | $22,000,000 | Other | Netherlands | Healthcare |

| Voyager Technology | $13,815,971 | Series B | China | Sensing |

Other companies attracting substantial rounds illustrate the broad range of company types that received funding in April 2024. For example, Kraken Robotics, a developer of unmanned underwater vehicles and sensors, pulled in $45 million, while Serve Robotics, a provider of autonomous mobile delivery robots, attracted $40 million. Other April funding leaders included Asensus Surgical ($20 million), a supplier of robotic laparoscopy systems, and humanoid robot provider Mentee Robotics ($17 million).

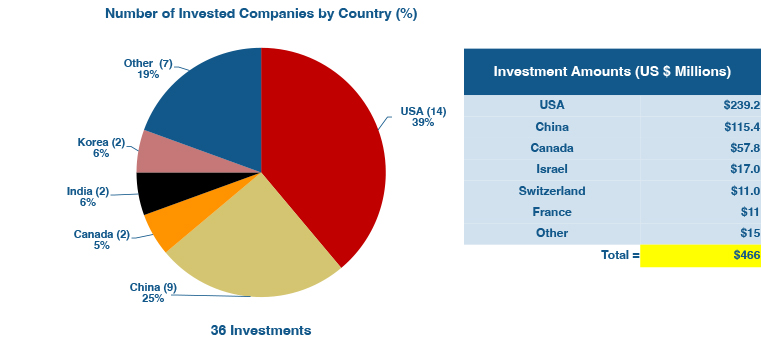

As with previous months, companies located in the United States and China received the largest funding amounts, $239 million and $115 million, respectively (See Figure 2). Companies based in the U.S. (14) and China (9) also received the majority of the rounds.

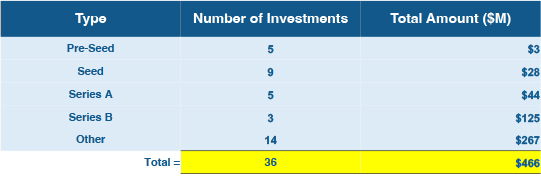

For both the total number of investments and the overall amount of funding, most fell into the ‘Other’ category, a catchall phrase for investment types that fall outside the typical stages of funding that businesses go through before their initial public offering (ex. Seed, Series A, B, C, D, E and F funding).

Figure 2: April 2024 robotics investment by country.

Figure 3: April 2024 robotics funding by investment type and amount.

Editor’s Note

What defines robotics investments? The answer to this question is central in any attempt to quantify them with some degree of rigor. To make investment analyses consistent, repeatable, and valuable, it is critical to wring out as much subjectivity as possible during the evaluation process. This begins with a definition of terms and a description of assumptions.

Investors and Investing

Robotics investments should come from venture capital firms, corporate investment groups, angel investors, and other sources. Friends-and-family investments, government/non-governmental agency grants, and crowdsourced funding are excluded.

Robotics and Intelligent Systems Companies

Robotics companies must generate or expect to generate revenue from the production of robotics products (that sense, analyze, and act in the physical world), hardware or software subsystems and enabling technologies for robots, or services supporting robotics devices. For this analysis, autonomous vehicles (including technologies that support autonomous driving) and drones are considered robots, while 3D printers, CNC systems, and various types of “hard” automation are not.

Companies that are “robotic” in name only, or use the term “robot” to describe products and services that do not enable or support devices acting in the physical world, are excluded. For example, this includes “software robots” and robotic process automation. Many firms have multiple locations in different countries. Company locations given in the analysis are based on the publicly listed headquarters in legal documents, press releases, etc.

Verification

Funding information is collected from several public and private sources. These include press releases from corporations and investment groups, corporate briefings, market research firms, and association and industry publications. In addition, information comes from sessions at conferences and seminars, as well as during private interviews with industry representatives, investors, and others. Unverifiable investments are excluded and estimates are made where investment amounts are not provided or are unclear.

Tell Us What You Think!