|

Listen to this article

|

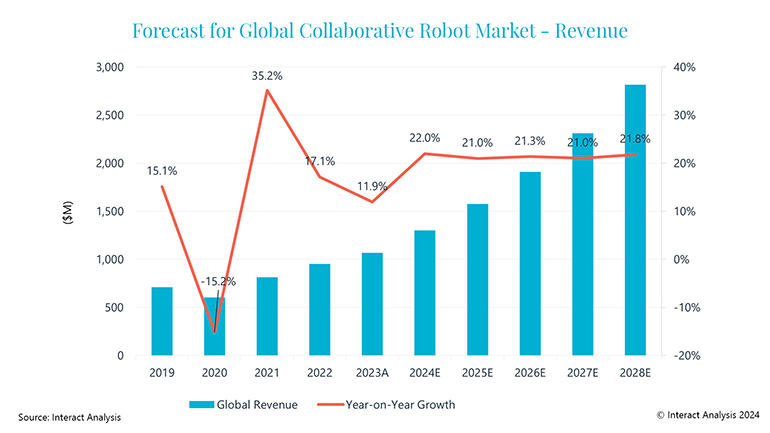

Global cobot market revenues are set to increase at >20% a year from 2024 to 2028. | Credit: Interact Analysis

The global collaborative robot (cobot) market topped $1 billion in revenues during 2023, despite overall demand recovering more slowly than expected post-pandemic, according to new data from Interact Analysis. Looking to the future, the market intelligence specialist predicts the global market for cobots will see a 22% increase in shipments during 2024 and anticipates similar levels of growth (>20%) each year through 2028.

- Global cobot market revenue exceeded $1 billion in 2023, despite lower-than-expected growth

- There has been a clear shift from individual to holistic solutions

- Market demand for cobots recovered more slowly than anticipated, but revenues are expected to grow at >20% between 2024-28

Interact Analysis also recently documented an increase in demand for integrated robot control. As recently as 2021, global tech market advisory firm ABI Research also predicted that the cobot market would grow substantially over the coming decade. According to ABI, the market had a global valuation of $475 million in 2020 (slightly lower than Interact’s numbers), which would expand to $600 million in 2021 and $8 billion in 2030, with a projected CAGR of 32.5%.

Interact Analysis believes that annual revenue growth for cobots was around 11.9% in 2023, despite a challenging year for manufacturing, tough economic conditions, and supply chain issues. Demand for cobots in the automotive and new energy industries remained high last year, but demand for cobots in electronics and semiconductors fell significantly, leading to a small V-shaped trajectory between 2022-24. Orders from the semiconductor and logistics industries are expected to bounce back in 2024, but high interest rates could weaken overall order intake this year.

Universal Robots (UR) remains the cobot market leader. UR generated $304 million in revenue in 2023.

“The global cobot market is becoming more refined, as end-users seek out holistic solutions rather than purchasing large pieces of equipment,” said Interact Analysis research manager Maya Xiao. “Over the coming year, we expect to see major cobot vendors target large customers, which could impact capacity and resource allocation.

“Moving forward, China will dominate the global cobots market in the medium term, but it is also the region where average revenue per unit (ARPU) is expected to fall most sharply, as competition in the market increases. The cobot market growth rate in regions other than China will approach that of China after 2025 and the global average market price for cobots is expected to increase slightly between 2023 and 2028 as demand grows for collaborative robots capable of handling larger payloads.”

This report answers these and other key questions facing the industry today. A premium version of the report is available with quarterly market movement updates, a mid-year market forecast, and granular data about cobots by country, by industry, and by payload.

Tell Us What You Think!