|

Listen to this article

|

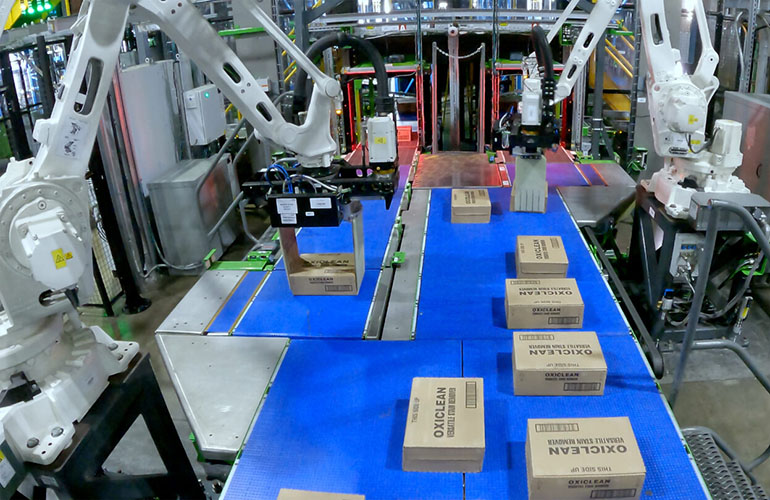

Symbotic uses AMRs and robotic arms to build mixed-case pallets. | Source: Symbotic

Symbotic, a developer of robotics for supply chain applications, announced the results of its fourth quarter and fiscal year ended Sept. 30, 2023. The Wilmington, Mass.-based company brought in $392 million in revenue in Q4 and $1.18 billion in 2023.

Symbotic’s revenue increased by 60% from Q4 of 2022, when it brought in $244 million. It saw a net loss of $45 million in Q4, down from $53 million it lost in the same quarter last year.

The company reported an adjusted EBITDA of $13 million, up from an adjusted EBITDA loss of $20 million in the same quarter last year.

“We are pleased to report another quarter of strong revenue growth and margins, as we initiated four new system deployments and completed commissioning of two systems,” said Tom Ernst, chief financial officer of Symbotic. “We also accelerated the pace of system deployments.”

“We are excited to be reporting our first quarter of positive adjusted EBITDA, which demonstrates the strong operating leverage of our business,” he added.

Cash, cash equivalents, restricted cash, and marketable securities on hand increased by $35 million from the prior quarter of 2023 to $548 million by the end of the fourth quarter.

A record year for Symbotic

Symbotic works with Albertson’s, the second-largest supermarket chain in North America after Kroger. It also partners with Target and Walmart, the seventh and largest retailers in the country, respectively. Walmart signed a deal last year to put Symbotic’s system into all 42 of its regional distribution centers over the course of several years.

For the entire fiscal year 2023, Symbotic recorded revenue of $1.18 billion, and a net loss of $208 million. It recorded an adjusted EBITDA loss of $18 million. For the full fiscal year 2022, Symbotic reported revenue of $593.3 million, meaning its 2023 fiscal year revenue jumped 98%.

Since Q4 2022, Symbotic has added seven operational systems and 17 deployments in progress, bringing the company to 12 fully operational systems and 35 systems in the process of deployment.

Symbotic debuted on the NASDAQ in June 2022 under the ticker “SYM” after completing its business combination with SVF Investment Corp. 3, a special-purpose acquisition company (SPAC) sponsored by an affiliate of Softbank Investment Advisors. Shareholders approved the transaction on June 3, 2022. This was the company’s first year as a publicly traded company, and it has seen huge growth throughout the year.

“This has been a year of tremendous growth and progress for Symbotic. Our financial performance is a testament to the hard work and dedication of our talented team,” stated Rick Cohen, chairman and CEO of Symbotic , in a release. “In fiscal 2024, we will continue to invest in driving innovation, strengthening our partnerships, and scaling for growth.”

What does 2024 have in store?

For Q1 2024, Symbotic said it expects revenue of $350 million to $370 million and an adjusted EBITDA of $11 million to $14 million.

This revenue could be boosted by Symbotic’s $7.5 billion new customer contract with GreenBox, its new joint Warehouse-as-a-Service venture with SoftBank. GreenBox will automate supply chain networks globally by operating and making Symbotic’s technology accessible to the warehouse. Starting in fiscal year 2024, GreenBox plans to order Symbotic’s systems over a six-year period.

Symbotic said its software is designed to orchestrate an entire fleet of robots to receive, store and retrieve a virtually limitless number of SKUs. Each robot is equipped with the company’s proprietary end-of-arm tooling and vision systems, which it claimed allows them to output cases, totes and packages at industry-leading speeds.

In addition, Symbotic offers an “end-to-end” system for mixed-case palletizing. It uses autonomous mobile robots (AMRs) called SymBots, as well as robotic arms with advanced vision and sensing capabilities.

Tell Us What You Think!